The volatility of the stocks market and the large daily volume of trades require good planning and efficient stock investment strategies, capable of guarantee in liquidity and increasing the profitability of a stock portfolio.

However, it is not always an easy task to be able to make the right decisions, since the emotional issue can interfere negatively in the negotiation process, generating insecurity.

Another impediment is the speed with which transactions occur. Regardless how attentive the investor may be, he is unable to identify unexpected opportunities and carry out buy and sell transactions as quickly as the market demands.

This scenario has favored the use of algorithms and robots that can automate the sending of trading orders to Exchanges in Brazil and internationally.

Big investors, who work with high volumes of trades, choose to use stock investment strategies through technologies such as algorithms or automated strategies to ensure greater agility to their operations.

And many of them have developed and tested, before putting into production, different trading strategies to achieve even more satisfactory results and increase the probability of profit with reduced risks.

If you still have doubts about the real benefits of using technology in the investment market, we have listed two main reasons that can change your mind:

• Speed: by automating your own stock investment strategies, you can track hundreds of transactions and trade assets instantly;

• Greater precision: by programming the parameters of your strategies correctly, the risk of loss is considerably reduced, optimizing your profitability and removing the emotional impacts of your operations on the Stock Exchange.

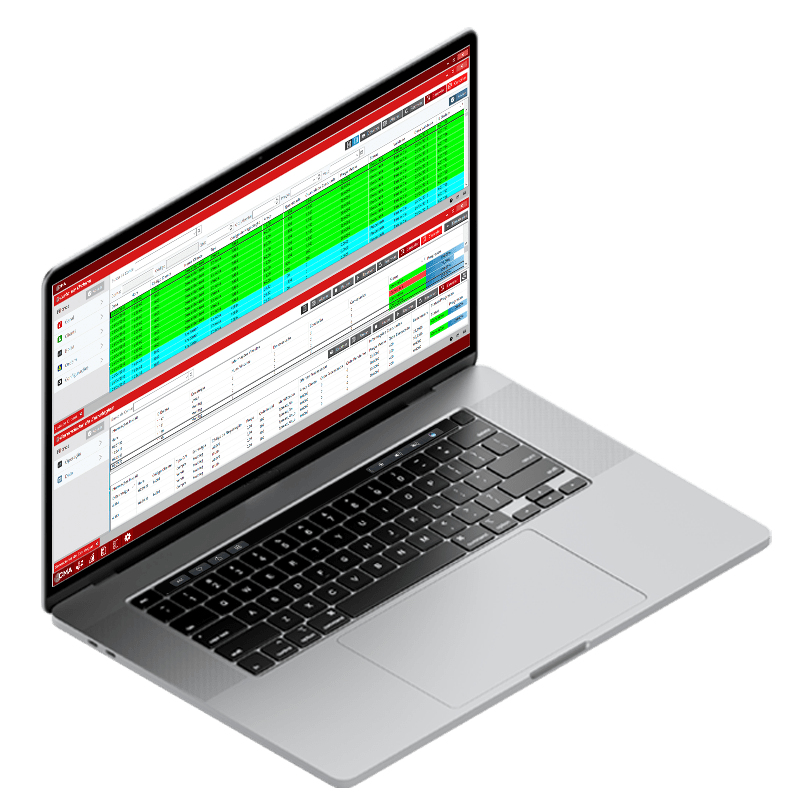

To help automate your own strategies for investing in stocks, options, dollar and futures markets, CMA developed the CMA Algorithms White Box, which has a very extensive library of mathematical functions for you to write your trading strategies using the main programming languages: C#, MATLAB, Python and Java.

However, it should be noted that before putting your stock investment strategies to operate on the Stock Exchanges, it is important to test them to see how they behave, analyzing the probability of profit / risk, when applied in a real trading environment.

Considering this, CMA included in the CMA Algorithms White Box a special environment for exchange simulator with full market data, “tick-by-tick”, for all Bovespa and BM&F stocks. In addition, CMA provides an extensive historical database.

Imagine being able to test the execution of orders, without risk of financial loss, continuously optimize your marketing strategies and considerably increase your chances of profiting.

This is the main objective of the exchange simulator environment available in the CMA Algorithms White Box, which guarantees, in a safe way, that you evaluate, whenever you want, the performance of your operational strategies without any financial risk. With it, you can send buy and sell orders exactly as if you were doing it on the live trading floor.

Another advantage is that this stock market simulator has extremely low latency and is very close to the real environment of B3, allowing to evaluate the behavior of the strategies configured in the CMA Algorithms White Box under real market conditions.

After all, you can't use your real money to test your strategies at B3.

The exchange simulator environment of the CMA Algorithms White Box works in three stages that guarantee a perfect execution of the tests of its proprietary strategies:

1. Total autonomy to develop your strategies through debugging modes and functional tests through “backtesting” using the asset history. It is also possible to select a day of your preference and execute the strategy with the real trades carried out in that trading session;

2. Using the exchange simulator validation tests of the developed strategies, you will have access to all reports with performances and stress tests, in addition to having total autonomy to configure your parameters and measure the impacts on the results of operations;

3. Realistic environment with several security triggers to ensure that the strategy will be executed according to the previously programmed settings.

The possibility of developing your own trading strategies and using a stock exchange simulator with extremely low latency and very close to the real environment, ensures that you optimize your settings continuously and more efficiently.

With complete resources to ensure greater agility to your trades and an efficient and reliable exchange simulator, the CMA Algorithms White Box is the only one in Brazil that offers all the functionalities necessary for you to operate using your proprietary strategies in a satisfactory way, with autonomy and security.

You can try the CMA Algorithms White Box and its exclusive stock market simulator for free. Request a free demo right now and increase your trading performance!

Uma solução exclusiva que suporta alta frequência de operações e elimina os longos processos que geram latência.

Copyright 2020 © CMA.